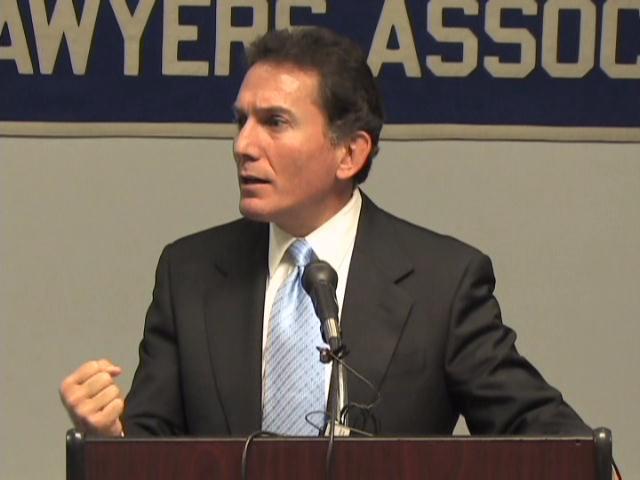

New publication on the rise of “nuclear verdicts” is a lobbying vehicle for insurance companies according to Personal Injury Attorney Ben Rubinowitz

Our managing partner Ben Rubinowitz, is a renown trial lawyer who has obtained many of the largest verdicts in New York State history. He was interviewed by Brian Lee, a litigation reporter for the New York Law Journal about a recent report by Marathon Strategies that puts New York State as the 10th state with the highest total number of what they call “nuclear” and “thermonuclear verdicts”. The report identifies “nuclear verdicts” as verdicts of $10 million and above and “thermonuclear verdicts” as verdicts of $100 million and above. According to their findings the number of verdicts against corporations in the US doubled between 2020 and 2022 with the median “nuclear verdict” increasing from $21.5 million in 2020 to $41.1 million in 2022.

Our managing partner Ben Rubinowitz, is a renown trial lawyer who has obtained many of the largest verdicts in New York State history. He was interviewed by Brian Lee, a litigation reporter for the New York Law Journal about a recent report by Marathon Strategies that puts New York State as the 10th state with the highest total number of what they call “nuclear” and “thermonuclear verdicts”. The report identifies “nuclear verdicts” as verdicts of $10 million and above and “thermonuclear verdicts” as verdicts of $100 million and above. According to their findings the number of verdicts against corporations in the US doubled between 2020 and 2022 with the median “nuclear verdict” increasing from $21.5 million in 2020 to $41.1 million in 2022.

The report indicates that corporations facing trial in New York are more likely to be hit by “thermonuclear verdicts” than in any other State. While at federal level two extraordinary verdicts account for most of the total of the large verdicts ($956 million in the fraud matter Liberty Media Corp. v. Vivendi Universal in 2012 and $253 million in the employment case Velez v. Novartis Corp. in 2010), verdicts in New York State courts were lower. The report indicates that 42% of the State verdicts above $10 million were cases related to product liability (such as asbestos cases), worker/workplace negligence and construction accidents. In regards to the last category the report points out that many of the large construction cases are related to the New York Labor Law 240 or “Scaffolding Law” which render employers strictly liable for workers injured as a result of inadequate or missing safety equipment at elevated work sites. With falls remaining the number one cause of death in the New York construction industry, the “scaffolding law” has proven instrumental in assuring that employers are providing the necessary fall safety equipment to their workers and making sure that they are always using it while working at heights.

Ben Rubinowitz sees the report as a “lobbying vehicle for insurance companies that don’t want to pay claims while raising the average consumers’ premiums”. Among the recent jury verdicts obtained by Ben was a $59 million verdict for Alonzo Yanes, a high School student who suffered catastrophic burn injuries in a botched science experimentation. Alonzo underwentmore than 100 surgeries and will remain disfigured for the rest of his life. While Judge Alexander Tisch considered the verdict appropriate, the final award was reduced to $29 million by the Appellate Division, First Department in 2021.

“I respect the Appellate Division and I always have and I always will,” Rubinowitz said. “But I’m telling you, for an injury like that, if it was your child, you would say it’s not enough.” “This child never gets a vacation. He never has the ability to walk down the street without somebody gasping. His face was burned off. Even the trial Judge felt the verdict was reasonable”

The problem is that insurance companies are only too happy to charge huge premiums to consumers but when they have to pay on legitimate claims they refuse to offer reasonable settlements. The CEO’s of these insurance companies are padding their own pockets while at the same time refusing to pay on legitimate claims. As reported by Rick Suttle:

Insurance Executive Salary

CEOs of large insurance companies receive tens of millions in salary, bonuses and compensation, as reported by the Wall Street Journal in 2021. For example, Chubbs CEO Michael Neidorff earned $24,956,777 in total compensation. Other CEOs leading the pack included CVS/Aetna CEO Larry Merlo and Aflac CEO David Amos annually earning $23,043,822 and$22,613,727, respectively.

The problem is this, according to Rubinowitz: Reasonable demands are made for horrific injuries and Insurance Companies refuse to offer reasonable settlements. Then we, as plaintiff’s lawyers, are forced to take a verdict. The jury then renders a fair verdict and the insurance company cries that the verdict is “nuclear.” Most of the verdicts never approach the amounts of money earned by the CEO’s in a single year – let alone what they make in 10 years – over $200,000,000. We will continue to fight for our clients. Insurance companies have huge amounts of money to promote their lobbying efforts in a selfish attempt to deprive many from receiving the justice they truly deserve.

Along with Peter Saghir, Ben also obtained a $41.5 million verdict for the family of a sanitation worker who struck and killed in a sweeper truck accident. The victim, a New York City Sanitation worker with 4 young children was crushed to deathby the negligence of a driver.

“The liability was so clear that the city of New York conceded liability,” Rubinowitz said. They never made a reasonable offer. And then they try and say that the verdict is “nuclear” or a “runaway verdict.” No, it’s not. These are reasonable numbers and the award was made by reasonable people (the jury) who understood the devastating effect the death of this husband and father of 4 has had on his family.”

Read the article in the New York Law Journal

New York Personal Injury Attorneys Blog

New York Personal Injury Attorneys Blog